The Old Contrarian Value Investing

I teach beginner investors proven methodologies for Value investing, Property Investing, and Portfolio Construction to give you the best chance possible to achieve above average returns on the stock market.

Free download: How to find the Intrinsic Value of a company

Why Value Investing?

Fundamental Analysis

This involves examining a company's financial health through its income statements, balance sheets, and cash flow. Understanding these metrics helps assess the company's intrinsic value.

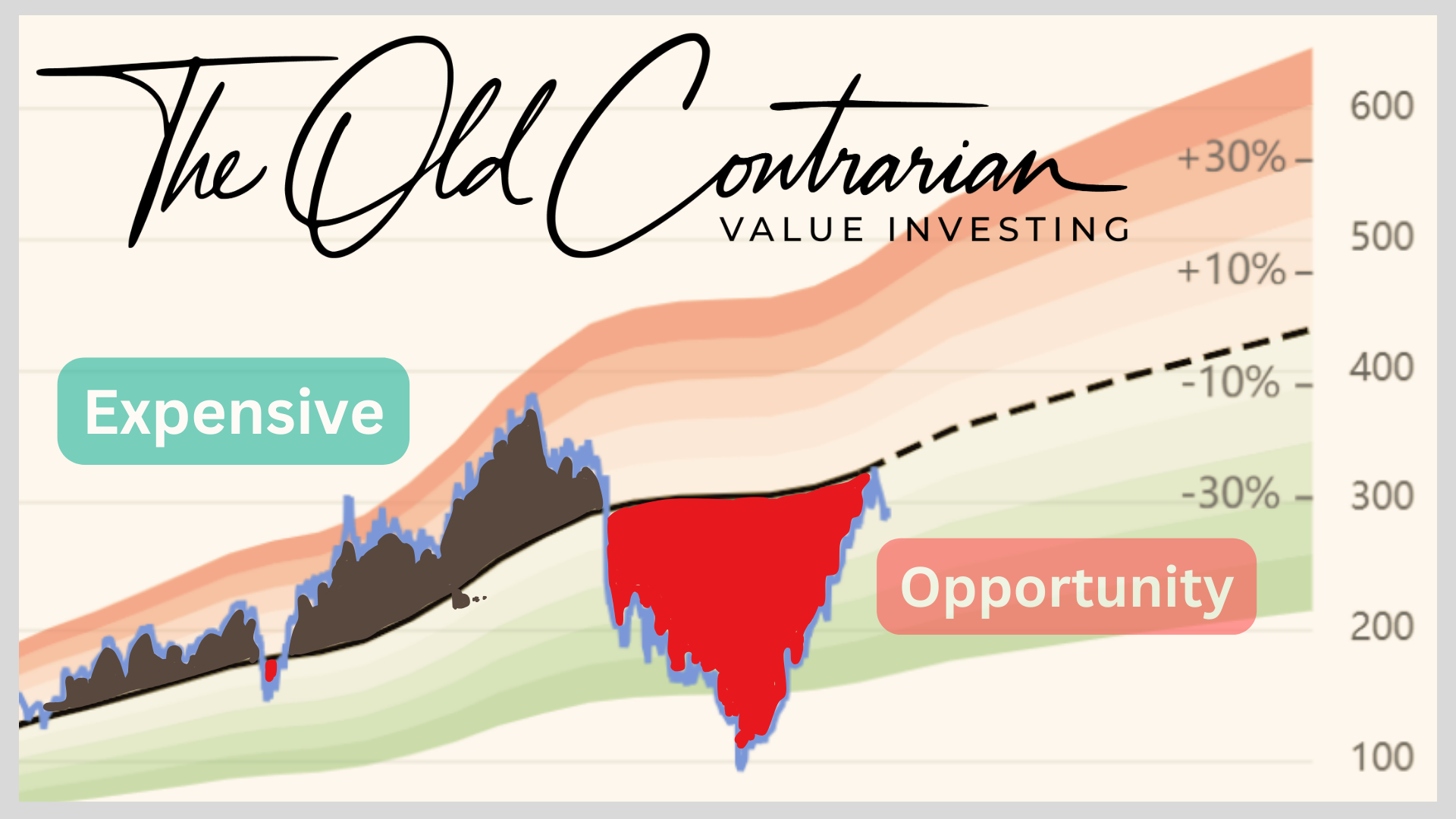

Margin of Safety:

Value investing focuses on buying stocks at a significant discount to their intrinsic value. This reduces risk and provides a cushion against market fluctuations, increasing the potential for substantial gains.

Long-term Perspective:

Patience is crucial in value investing. Investors focus on the sustained growth potential of their investments, capitalizing on the gradual appreciation of undervalued stocks over time.

Hi, I’m the Old Contrarian

An experienced business leader in Global Industrials I have over 20 years of general management experience, specializing in operations and capital investment.

Having lived in 10 different countries around the world, I have played a significant role in mergers and acquisitions, leading countless business cases for strategic investment in multi-billion-dollar companies.

MORE ABOUT ME →

Value Investing Courses

The Old Contrarian Value Investing offers various courses to teach beginner investors proven methodologies.

We never offer investment advice, but simply teach how to value investments, so you can make informed investment decisions.

VIEW ALL COURSES →Giving back

The Old Contrarian is dedicated to providing education for individuals seeking wealth growth and aims to break the cycle of poverty by educating children globally.

Education plays a crucial role in breaking the poverty cycle worldwide. We will play our part to make sure every willing child gets the education they deserve.