How can you get 8% returns from Costco Wholesale?

May 25, 2024

Growth

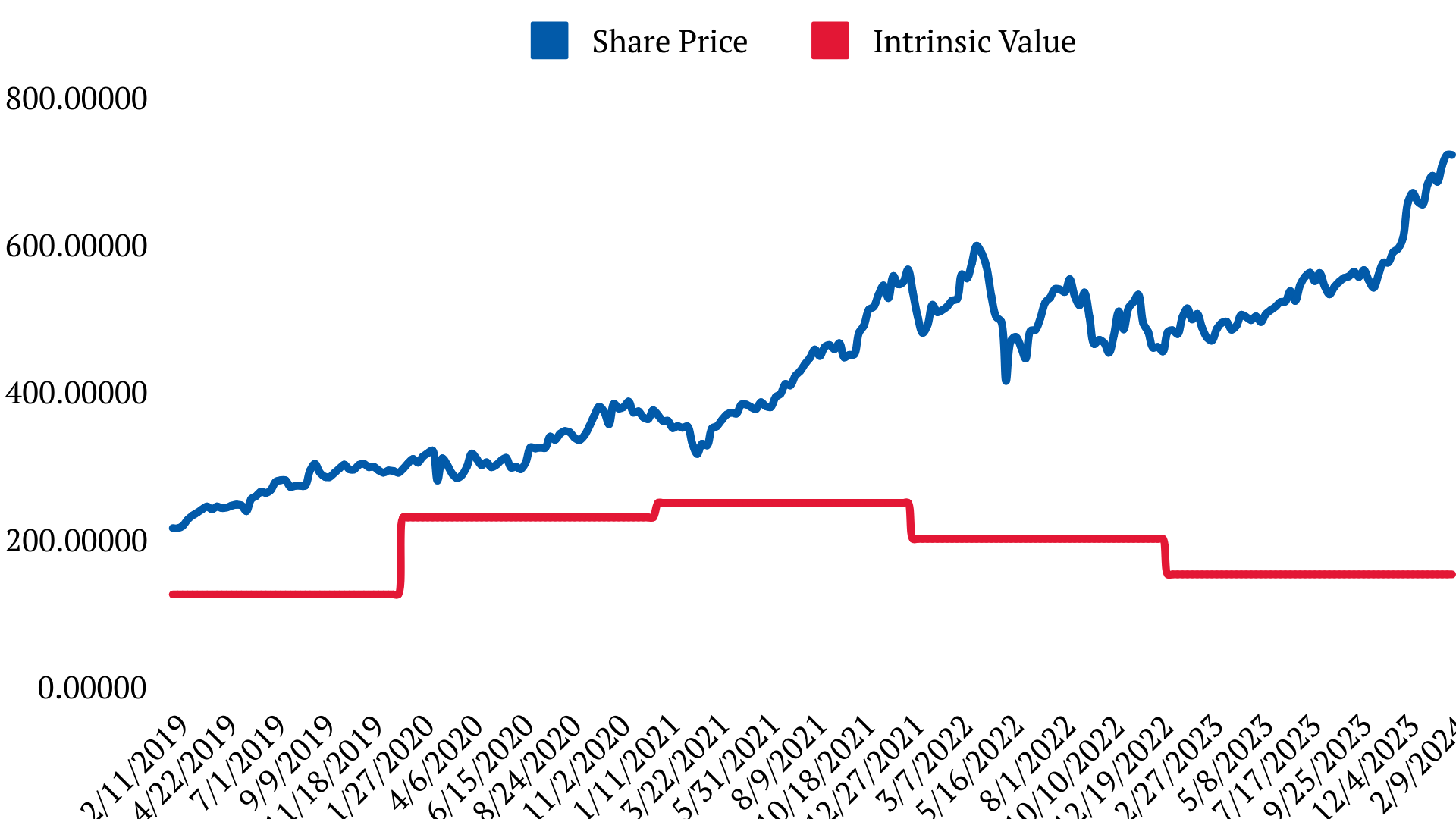

I will show you how I believe you can invest in Costco and still see expected returns of around 8%, even when the share price looks high. Costco is a monster, some would say a cash machine, and it keeps getting bigger and bigger. Revenue, profit, equity all keeps growing.

It is known for carrying brand name merchandise at lower prices than you will find in other retail outlets. Its business model is the epitome of stack it high, sell low. It is a brilliant business model and it one of the largest retailers in the world. But is it worth buying it now?

The share price is elevated to say the least, and I would agree if you were to value the business on the asset value or the earnings, you would not arrive at a valuation that you tempt you in.

However, if you value the business on the potential growth, it tells you a whole other story. But how do you value growth?

We build this picture by looking at three things. Firstly, the Distribution yield, second the expected returns related to growth, and third the organic growth of the economy.

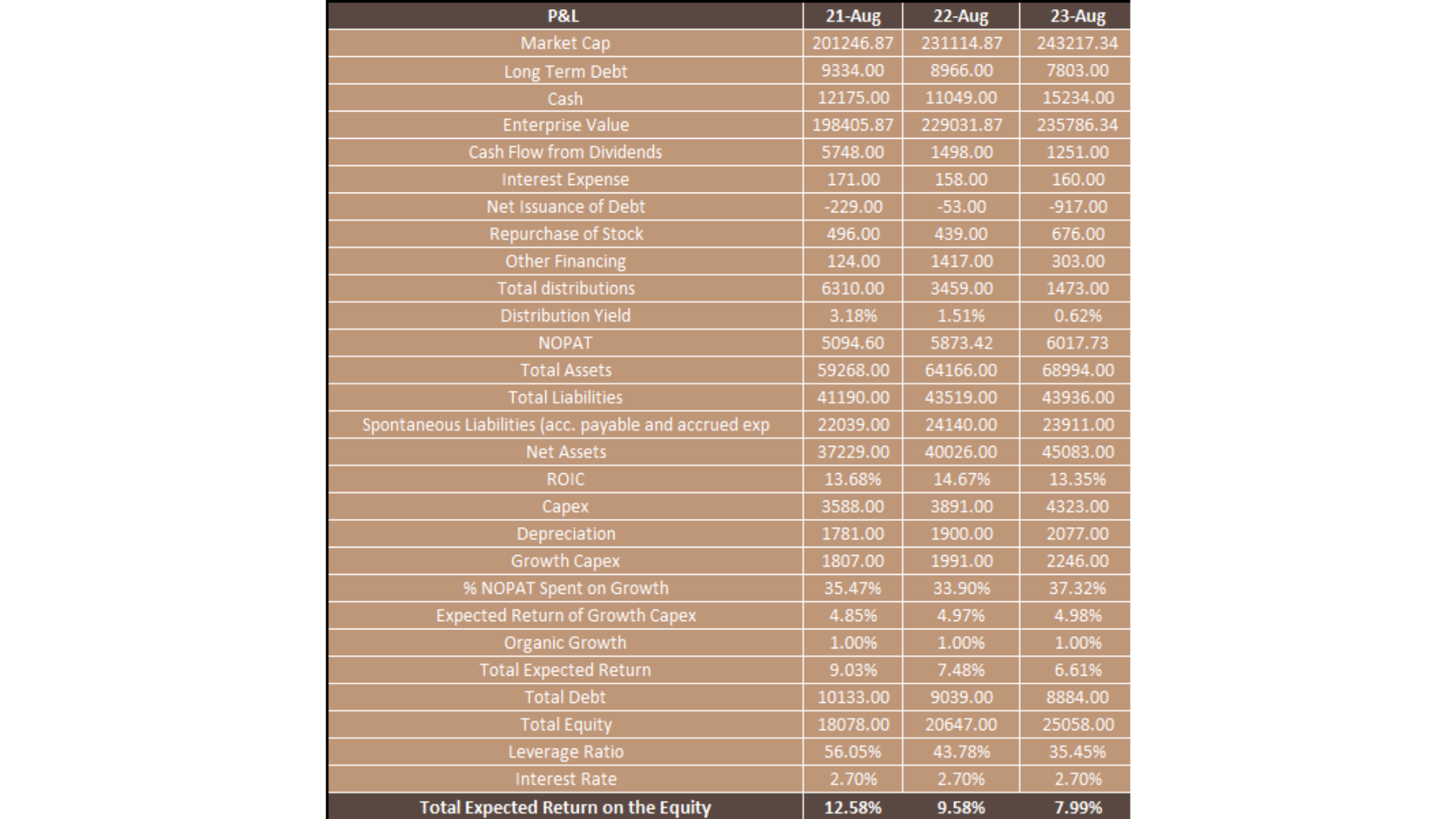

Let's start with the distribution yield, by working out the enterprise value. To find the enterprise value, we look at the current market cap and make adjustments for debt and equity. At the end of financial year in Aug 2023, the market cap sat at 243.217 bn dollars, and if we adjust for long term debt and cash, we reach an enterprise value of 235.786 Bn Dollars.

With Enterprise calculated, we look at what is being distributed out to stakeholders, as a percentage of that enterprise value. Such as the $1.25 billion dividends paid to shareholders; interest expenses of $160 million that is being paid to the bank to Service our loans; a net issuance of debt of -917 million dollars, which is money flowing into the business as Costco takes on more debt; repurchases of stock for $676 million; and there's other finances related to around $303 million. The total distribution out to stakeholders for Costco is 1.473 billion. This number divided by the total enterprise value of $235 billion, and we get a measly distribution yield of 0.62%. So, we can say that 0.62% of the enterprise value of the business is being distributed back to stakeholders. This is the first portion of our returns.

The second portion of our returns looks at the expected returns based on the future growth of Costco. This is where the greatest value lies.

Firstly, we need to understand what kind of returns Costco has been making on their invested capital to date, and we do this by looking at the return on invested capital.

So we start off by looking at the assets, and make adjustments for spontaneous liabilities, which leaves us with a net asset position of $45.083 billion.

Now to workout the return on invested capital, we take the Net operating profit after tax for each year and divide that by the net assets. So in 2023 take a net operating profit after tax of just over $6 billion, and divide that by the net assets of $45.083 billion, resulting in a return on invested capital of 13.35%.

So, when the company invests capital into the business these are the types returns that you could expect to see from Costco on that invested capital.

Therefore what we need to establish is what kind of capital will be invested into the future, and assume we'll get the same returns on that capital invested. Luckily for us each business tells us this and Costco is no different they've invested $4.323 billion of capital investment in 2023.

Now some of this capital will go to maintaining the business as it is presently, and we call this maintenance CapEx and this is just over $2 billion. Therefore, there's going to be $2.246 billion of capital expenditure that would be concentrated purely on growth. If I can take that $2.246 billion worth of growth CapEx and divide that by my net operating profit after tax I can establish that for 2023 that 37.32% of the net operating profit after tax will be spent on growth for Costco the following year.

We then look at the net operating profit after tax multiplied by the return on invested capital that the company has seen in previous years and then I get my expected growth in terms of returns and for 2023 this results in 4.98%.

We add distribution yield of 0.62% to my expected returns from growth CapEx of 4.98% to expected organic growth of 1% looking at the economic growth for the year to give me a total expected return of 6.61%.

To know my expected returns for every dollar invested in equity I can adjust for leverage and for Costco if I adjust for leverage it takes my total expected returns to 8%. Not a terrible return from a fantastic company, even at todays share price.

For me Costco is a great company that I always pick up every time the share price drops, and I will be using the total expected returns on equity as one method of intrinsic value.

General Overview

Costco Wholesale Corporation operates an international chain of membership warehouses, mainly under the “Costco Wholesale” name. These warehouses carry quality, brand-name merchandise at substantially lower prices than are typically found at conventional wholesale or retail sources. Here are some key points about Costco’s business:

- Product Selection: Costco warehouses offer one of the largest and most exclusive product category selections under a single roof. Their product range includes groceries, candy, appliances, television and media, automotive supplies, tires, toys, hardware, sporting goods, jewelry, watches, cameras, books, housewares, apparel, health and beauty aids, furniture, office supplies, and office equipment.

- Quality Brands: Costco is known for carrying top-quality national and regional brands. They also offer a 100% satisfaction guarantee. Additionally, members can shop for private label Kirkland Signature™ products, which are designed to be of equal or better quality than national brands.

- Business Focus: Costco focuses purely on price. They buy in bulk and sell in bulk, passing on the savings to their members. Their warehouse-style stores cater to large families and businesses.

- No-Frills Approach: Costco eliminates many frills and costs associated with conventional wholesalers and retailers. They run a tight operation with extremely low overhead, allowing them to offer dramatic savings to their members.

- Membership Types: Costco is open only to members and offers three types of membership:

- Executive Members: They receive additional savings on Costco Services and earn an annual 2% Reward on qualified Costco purchases.

- Business Members: Qualify by owning or operating a business. They pay an annual fee to shop for resale, business, and personal use.

- Gold Star Members: Individuals who may purchase for their personal needs.

PEST Analysis

Let’s delve into a PESTLE analysis of Costco Wholesale Corporation, examining various external factors that impact its business:

- Political Factors:

- Costco maintains a stance of being separate from mainstream politics. They avoid involvement in political campaigns or funding.

- In 2019, there were allegations that Costco profited from Uighur Muslims in detention camps in Xinjiang, China. The clothes sold by Costco were allegedly produced using forced labor. However, Costco denies any association with forced labor and emphasizes its ethical supply chain.

- In 2020, Costco gradually phased out products from the company “My Pillow” due to contractual reasons.

- Economic Factors:

- As a membership-based retailer, Costco focuses on providing value to its members. Their bulk-buying model allows them to offer competitive prices.

- Economic fluctuations can impact consumer spending, affecting Costco’s revenue and profitability.

- Socio-Cultural Factors:

- Costco’s universal membership concept has resonated with consumers. Their no-frills approach appeals to large families and businesses.

- The brand’s commitment to quality and satisfaction has contributed to its popularity.

- Technological Factors:

- Costco has embraced technology in its operations, including online sales and efficient supply chain management.

- Technological advancements impact logistics, inventory management, and customer experience.

- Legal Factors:

- Costco faces legal considerations related to labor practices, product liability, and compliance with regulations.

- The company’s ethical supply chain practices are crucial in avoiding legal issues.

- Environmental Factors:

- Sustainability and environmental responsibility are increasingly important. Costco’s practices related to waste reduction, energy efficiency, and sourcing play a role in its reputation.

Porters 5 Forces

Let’s analyze Costco Wholesale Corporation using Porter’s Five Forces model to understand the competitive forces impacting its business:

- Competitive Rivalry or Competition (Strong Force):

- The retail industry is highly competitive, and Costco faces intense rivalry from other retailers, including Walmart, Sam’s Club, and Amazon.

- To maintain its position, Costco must continually enhance its competitive advantages, such as its no-frills approach, bulk-buying model, and efficient supply chain.

- Bargaining Power of Buyers or Customers (Strong Force):

- Costco’s customers (members) have significant bargaining power due to their membership fees and the availability of alternative retailers.

- The company’s focus on value, quality, and customer satisfaction helps mitigate this force.

- Bargaining Power of Suppliers (Weak Force):

- Suppliers have less influence on Costco due to its large-scale purchasing and strong relationships with suppliers.

- The company’s ability to negotiate favorable terms and maintain a diverse supplier base reduces supplier power.

- Threat of Substitutes or Substitution (Strong Force):

- Substitutes are readily available in the retail industry. Consumers can choose from various retailers, both online and offline.

- To address this threat, Costco must continuously improve its goods and services to retain customer loyalty.

- Threat of New Entrants or New Entry (Moderate Force):

- While barriers to entry exist (such as economies of scale and brand reputation), new entrants can still compete.

- Costco’s established market presence and unique membership model act as entry barriers, but the company must remain vigilant against potential newcomers.

In summary, Costco faces challenges related to most of the five forces. Its strategic direction should focus on maintaining competitive advantages, enhancing customer experience, and adapting to changing market dynamic

Segment & Competition

Let’s explore some of Costco’s main competitors and their respective strengths and weaknesses:

- Walmart:

- Strengths:

- Global Presence: Walmart operates over 10,500 stores worldwide, making it a significant player in the retail industry.

- Diverse Product Range: Like Costco, Walmart offers a wide range of products, including groceries, electronics, clothing, and home goods.

- Competitive Pricing: Walmart competes with Costco in the grocery sector, providing competitive prices for everyday essentials.

- Weaknesses:

- Sam’s Club (Warehouse Club):

- Strengths:

- Membership Model: Similar to Costco, Sam’s Club operates on a membership-based model.

- Bulk Purchasing: Sam’s Club offers bulk-buying options, appealing to businesses and large families.

- Weaknesses:

- Target:

- Strengths:

- Diverse Product Categories: Target provides a wide variety of products, from clothing to home goods.

- Convenient Locations: Target’s numerous stores offer convenience to shoppers.

- Weaknesses:

- Limited Membership Model: Unlike Costco, Target does not operate on a membership-only basis.

- Pricing: Target may not always match the competitive pricing of warehouse clubs like Costco.

- Amazon:

- Strengths:

- Online Dominance: Amazon’s vast online platform offers convenience and a massive selection of products.

- Prime Membership: Amazon Prime provides additional benefits to subscribers.

- Weaknesses:

- Lack of Physical Stores: Unlike Costco, Amazon lacks physical warehouse locations.

- Membership Fees: Amazon Prime requires an annual fee, unlike Costco’s no-frills membership.

- ALDI (Online Discount Retailer):

- Strengths:

- Cost-Conscious Approach: ALDI focuses on low prices and cost-effective operations.

- Private Label Brands: ALDI offers its own private label products.

- Weaknesses:

- Limited Product Selection: ALDI’s product range is narrower than that of Costco.

- No Membership Model: ALDI does not have a membership-based system.

- Home Depot (Home Improvement Retailer):

- Strengths:

- Home Improvement Focus: Home Depot specializes in tools, appliances, and home furnishings.

- Strong Brand Reputation: Known for quality and expertise in home improvement.

- Weaknesses:

- Limited Grocery Offerings: Home Depot does not compete directly with Costco in the grocery sector.

- No Membership Model: Home Depot operates without a membership system.

Remember that each competitor has its unique value proposition, and consumers choose based on their preferences, needs, and priorities. Costco’s strengths lie in its efficient supply chain, strong brand reputation, and unique membership model, while its weaknesses include limited product variety and minimal customer service

Value Chain

Let’s delve into the value chain analysis for Costco Wholesale Corporation. The value chain concept, introduced by Michael Porter, focuses on understanding how a company creates value through its various activities. Here’s an overview of Costco’s value chain:

- Primary Activities:

- Inbound Logistics:

- Costco’s supply chain starts with sourcing products from suppliers. They negotiate bulk purchases to achieve cost savings.

- Efficient transportation and inventory management ensure timely delivery to warehouses.

- Operations:

- Costco’s warehouses are designed for efficiency. They maintain a no-frills approach, emphasizing product quality and low prices.

- Bulk packaging and minimal handling reduce operational costs.

- Outbound Logistics:

- Warehouses distribute products to members. Efficient logistics help maintain low prices.

- Online sales and home delivery options enhance customer convenience.

- Marketing and Sales:

- Costco relies on word-of-mouth marketing and its membership model.

- Their unique selling proposition (USP) is quality products at competitive prices.

- Limited advertising expenses due to their membership-based customer loyalty.

- Service:

- Excellent customer service is essential. Costco prioritizes member satisfaction.

- Hassle-free returns and responsive customer support contribute to their reputation.

- Support Activities:

- Infrastructure:

- Costco’s corporate culture emphasizes ethical behavior, compliance, and employee well-being.

- Efficient management structures and decision-making processes.

- Human Resource Management (HRM):

- Employee training and development are crucial. Costco invests in its workforce.

- High employee satisfaction leads to better customer service.

- Technology:

- Information technology plays a significant role in Costco’s operations.

- IT systems manage inventory, track sales, and optimize supply chain logistics.

- Procurement:

- Costco’s procurement strategy focuses on direct sourcing and strong supplier relationships.

- Negotiating favorable terms and maintaining quality standards are priorities.

- IT Impact:

- Costco leverages IT to:

- Enhance supply chain management.

- Improve customer engagement through online platforms.

- Optimize operational efficiency.

In summary, Costco’s value chain emphasizes cost-effective operations, quality products, and exceptional customer service. Their membership model and efficient supply chain contribute to their success.